Memo

Rethinking Commercial Real Estate

Introducing a New Model for Vacant Office Assets

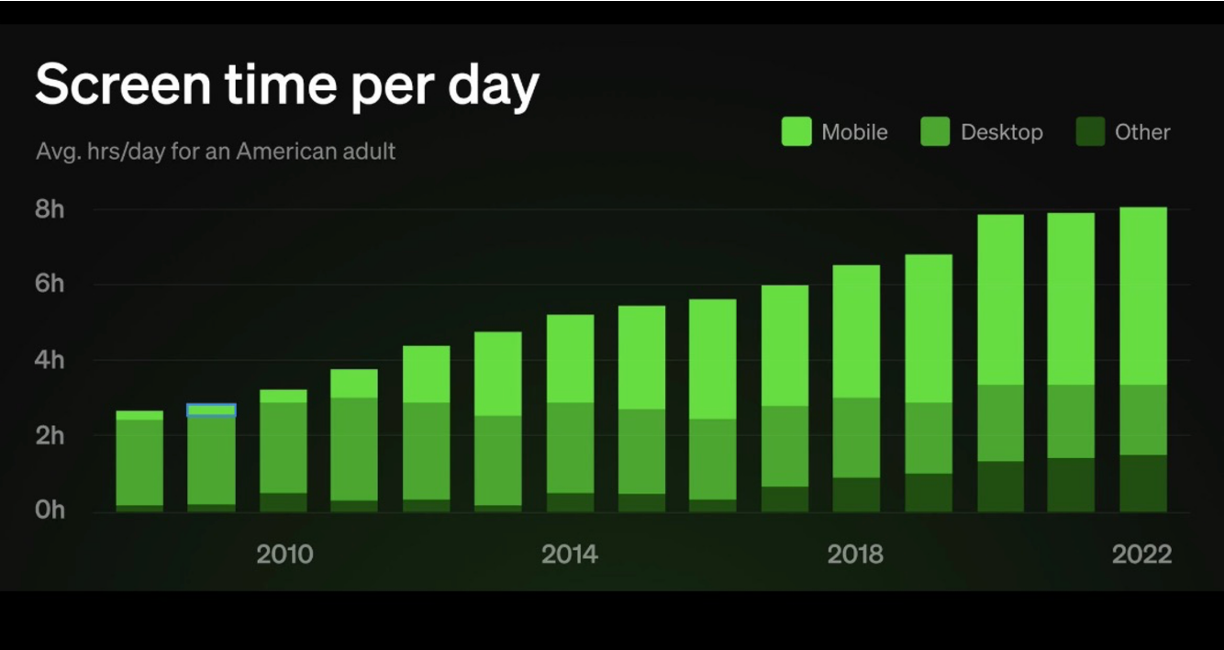

Over the past few years during the pandemic, we have witnessed a tectonic shift in our lifestyle dynamics, blurring the boundaries between workspaces and our homes. Historically, people have occupied three primary spaces: home, office, and social venues. For many, remote work has merged our primary two spaces: home and work, and as home and office converged, people lacked spaces that fulfilled critical social needs. In-person meetings and events evaporated. Spontaneous collisions became fewer. Watercooler chats disappeared. Concurrently, our third space, the social sphere, is fading as people’s digital screen time is proliferating, replacing human interactions. As a result, a societal void is developing, reducing opportunities for genuine, in-person, bond-forming connections.

Screen time consuming our lives was underscored during Apple’s Vision Pro Keynote presentation on June 2023, where they reveled the average screen time across its devices have increased from less than 2 hours a day to 8+ hours a day in the last 20 years1. This is an alarming amount of time in front of our screens, with no signs of slowing down, evidenced by outsized investments recently made by Meta, formerly Facebook and Microsoft, investing $10 Billion and $70 Billion in Metaverse and digital initiatives respectively2.

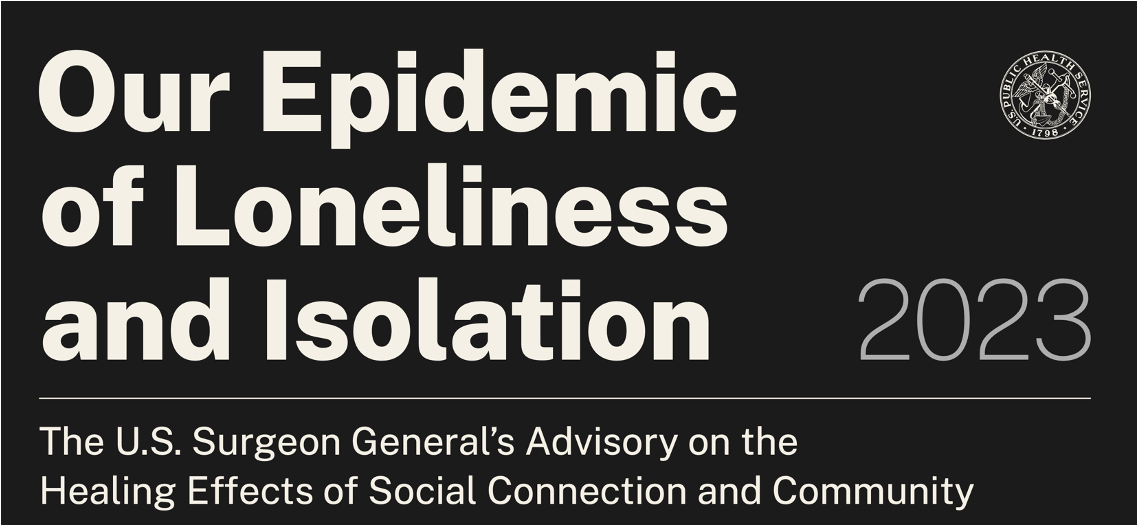

The Surgeon General of United States has even taken notice of these shifts in our social infrastructure, calling attention to the public health crisis of loneliness, isolation, and lack of in-person connection in our country3. Furthermore, Harvard business review published a research paper comparing the personal and work networks of hundreds of individuals pre- and post pandemic, and found that we’re losing touch with our networks. Our professional and personal networks have shrunk by close to 16%, or by more than 200 people during the pandemic4. Network shrinkage has consequences: narrowed networks make finding jobs harder, limits career growth, and decreases sense of belonging at work, making them more likely to leave. Simultaneously, a second crisis is emerging as the threads of our social fabric are fraying, the impact is also being felt across commercial real estate.

Commercial Real Estate (CRE) is lonely too- a crisis or opportunity?

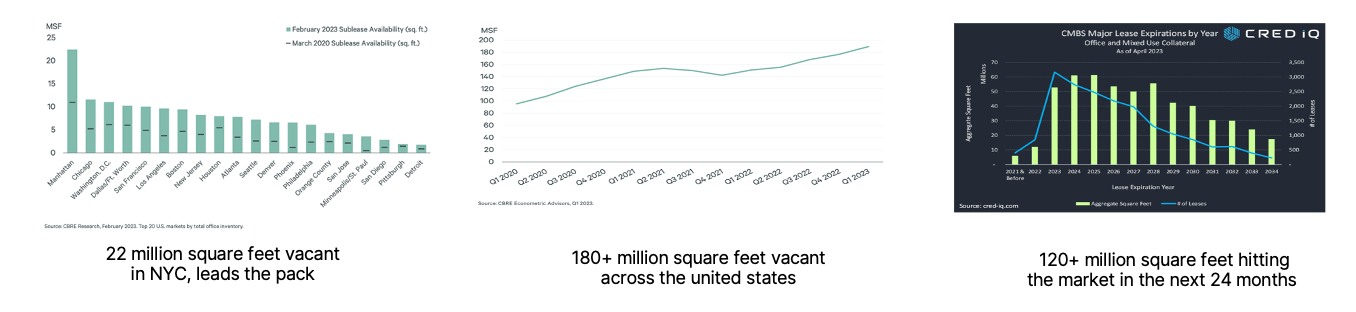

Existing commercial real estate office models face systemic threats. Changing demand, rising vacancies, uncertain valuations — The market is now grappling with a rapidly approaching breaking point. Key industry players such as Brookfield Corp faced significant setback, most notably defaulting on a 161 million USD loan in April 2023, largely due to an uncontrollable surge in office vacancies5. This grim scenario is underlined by the stark reality that NYC leads the nation with 22 million square feet of vacant space. This figure is felt nationwide, with over 180 million square feet lying empty across the country6, and unfortunately it’s probable to get worse, with an additional 120 million square feet slated to hit the market in the next two years7.

The Cushman & Wakefield Q1 & Q2 2023 report8 further illuminates the gravity of the situation, laying down concrete numbers that indicate what the commercial real estate market is about to encounter. This analysis reveals a significant trend such as, the national vacancy rate increasing 14 consecutive quarters, with 19.2% of office inventory sitting empty9 and in the month of August, the commercial mortgage-backed securities delinquency rate for the office sector has increase 17% month over month10. The natural progression of long to intermediate-term rolling leases coupled with ongoing refinancing difficulties at loan maturity are causing the velocity of new delinquencies to accelerate during 2023.

The onset of 2023 has witnessed an accelerated decline in the demand for traditional office spaces, fueled partly by themes we’ve covered to this point; surge in flexible work demands that are driving tenants to shed space and cut down their real estate footprint, and digital screen time replacing human interaction. Adding to the concern is number of contractual office leases expected to expire in 2024 and 2025, with each of the next 2 years facing over 60 million square feet of office space, represented over 5000 expiring leases across the nation ready to flood the market with inventory. As daunting as the challenges in commercial real estate and the rise of isolation are, an opportunity exists in this contradiction - vacant offices waiting for occupants alongside people starved of authentic in-person connection. We believe by reimagining obsolete office assets into energizing hubs of innovation and community, both problems can be addressed at once, helping write the comeback story – Properties with purpose.

Seizing the opportunity

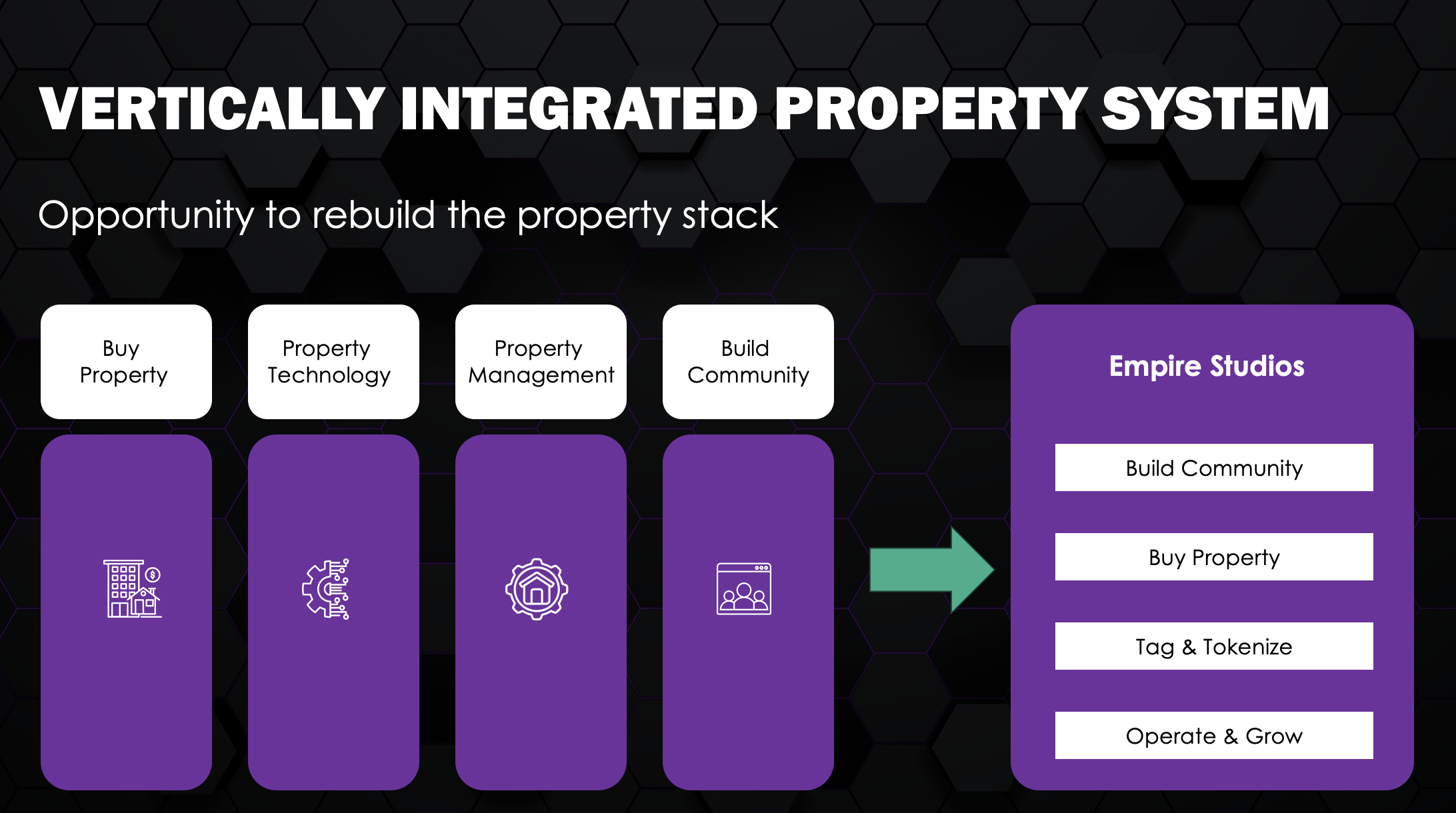

We plan to operate purpose-built spaces that are attractive to creators: founders, artists, and video gamers. Creative spaces include co-working, video gaming lounges, media studios, and event space. Initially, the Company has targeted real estate in the New York & New Jersey markets, but also intends to invest in other major markets across the United States and internationally.

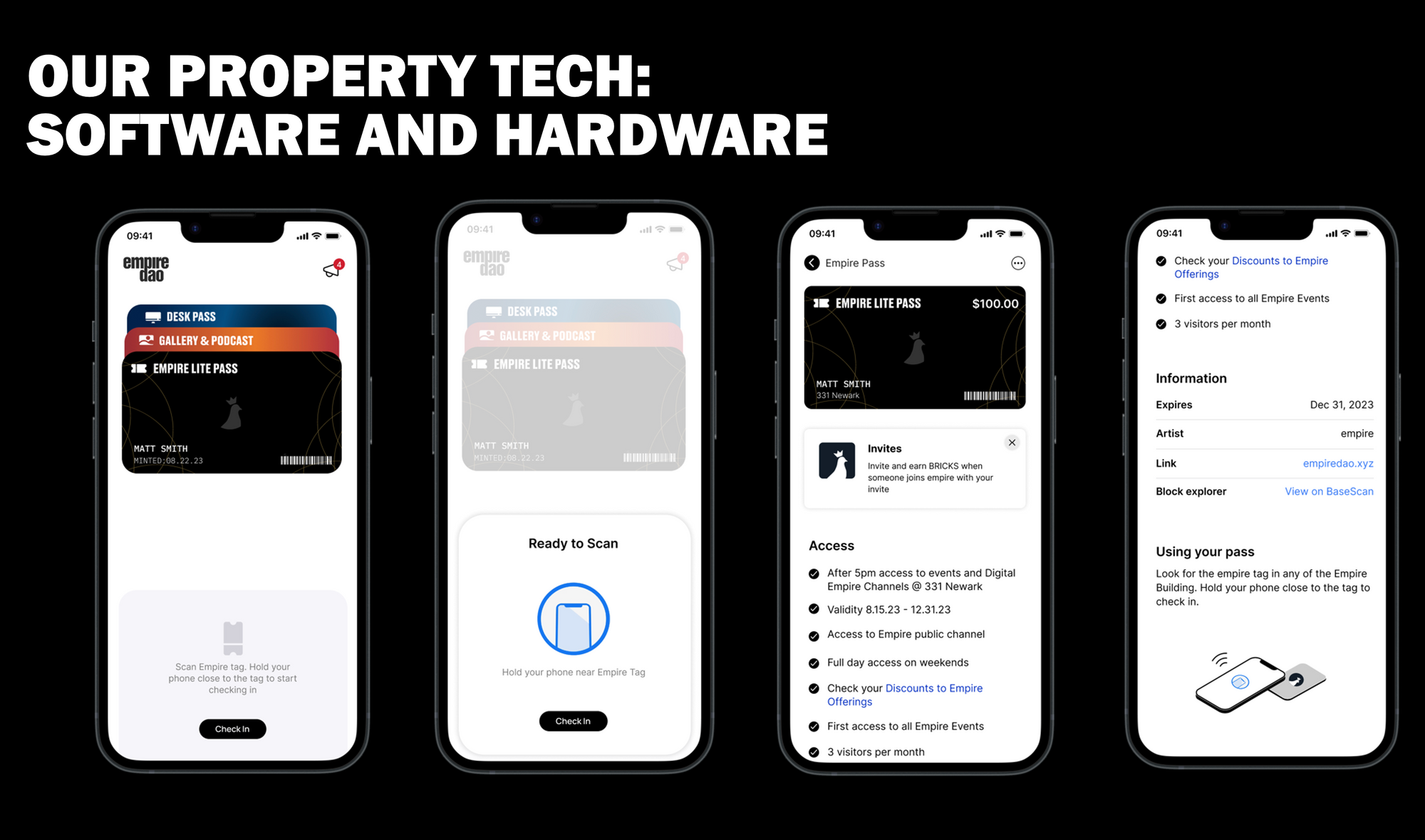

We intend to then install, operationalize and grow the Empire subscription membership model which aims to connect the value of our properties into a branded network of creative spaces that its members can access, creating an environment that connects like-minded people. Recognizing that co-working and shared spaces is not a new concept, we've designed a new model that incentivizes renters and club members to stay active longer, aligning interests, creating a sustainable business model enabled by technology.

Many property tokenization projects are aiming at a different mark.

Current real estate tokenization projects have made strides in democratizing access to property investment through fractional shares. However, we're applying these technologies differently, and towards addressing the critical vacancy and adjacent societal issue - loneliness. By connecting people to properties with purpose, we can uncover a unique opportunity to breathe new life into depressed and dormant properties, that benefit both Commercial Real Estate investors and people seeking meaningful interactions that lead to their professional and personal growth.

We believe that tokenization is part of the process to enabling the dematerialization of property, however new, innovative models and digital markets are needed that dramatically remove the cost and friction from utilizing space, on demand.

We also believe our incentive model will change the game entirely and one of our early differentiators, which present challenges in our competitors strategy, is the EmpireDAO community.

Disrupting the market

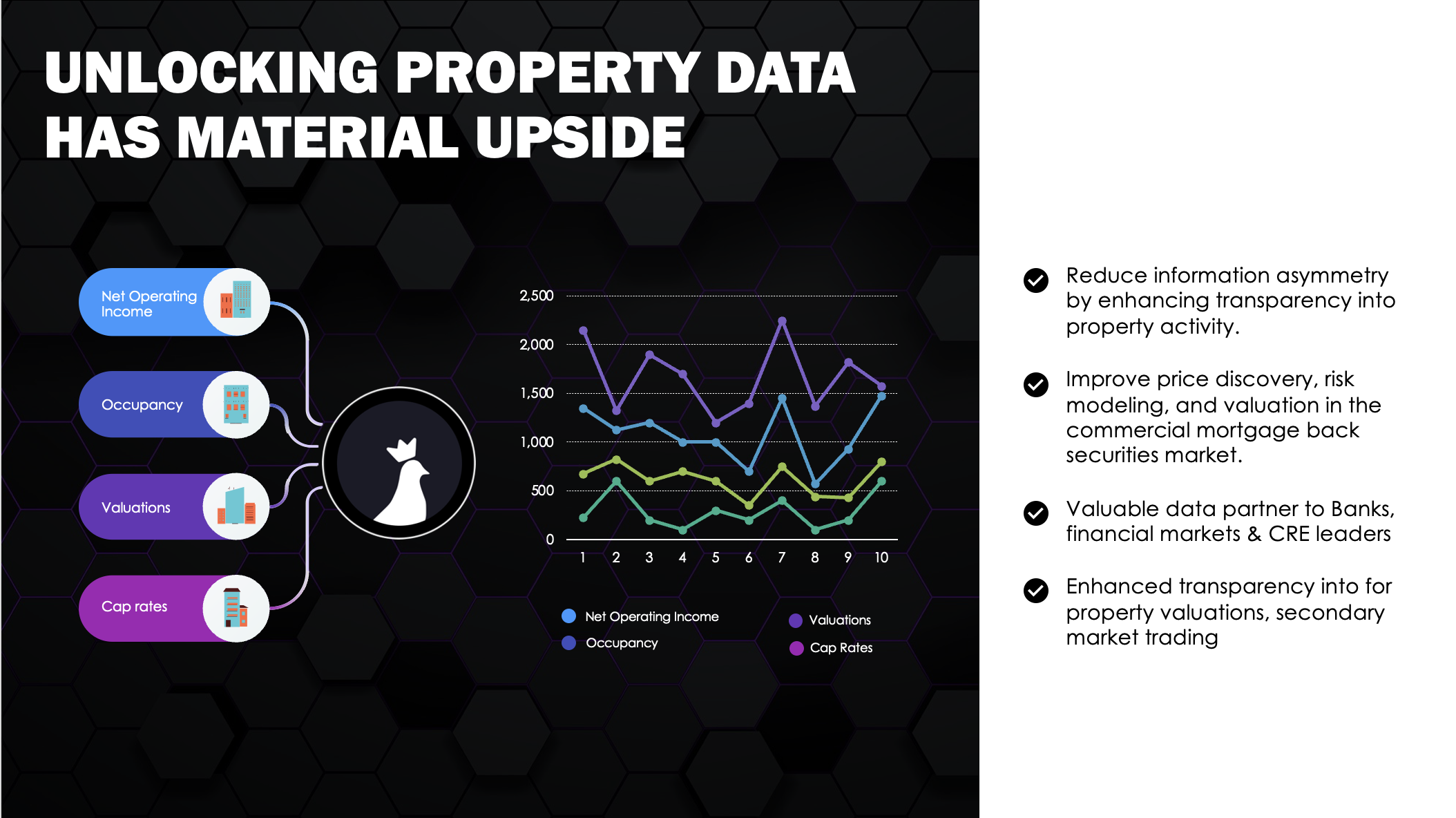

We intend to create value with a purpose-built protocol to fill vacant space at the speed of flash. We plan to build decentralized infrastructure that accelerates the velocity at which property can operate, powered by tokenization. By applying the benefits of programmable value to real-estate business models, we believe it will optimize a building’s profitability, by introducing composability, and removing cost and friction from its operating model. We see this directly translating into increased net operating income and cap rates for each Digitized property.

Our vision is to become a multi-player force in the real-estate field, managing a top 10 REIT as measured by AUM. We plan to achieve this while developing a very valuable business around integrating new and existing commercial real-estate assets into our protocol around the globe.

Traction

We have active prospects interested in exploration. We’re already managing business interest with major real-estate actors, and corporates within the US-and abroad about how we’re leveraging community and ownership technology capabilities to fill blocks. A small team (5 people planned by year end) will start developing leads, while the technical team build out the protocol and interfaces needed to operate and scale our user base.

- We’re focused on exploring the needs of large commercial real-estate owners and how to solve a very specific problem- increasing their net operating income and Cap Rates by optimizing the property’s operating model.

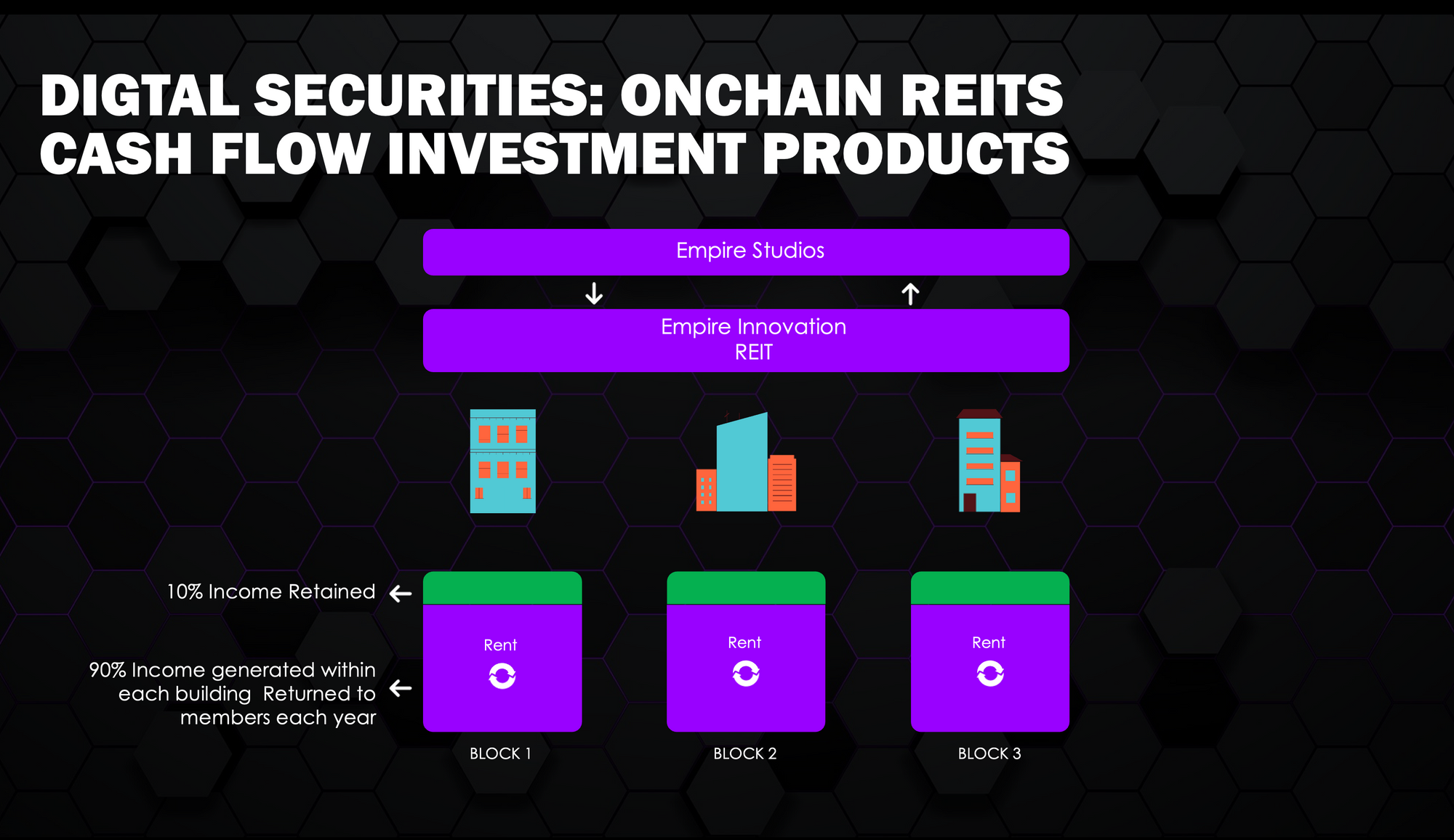

- We're carving out a new segment within the Real Estate Investment Trust market by launching The Empire Innovation REIT, which we plan to install, and operate our capabilities within the funds properties.

- Continuing to grow our vibrant community of highly skilled creators, building our demand pipeling with over 800 member waitlist, along with 200 event applications. This drives us to create media and entertianment programming, to continue to grow our membership, which will ultimately drive demand for our Building vacancies.

The Right Squad

George Bonano AKA Skinny Blocks

Experience at Wells Fargo Digital Assets, BNY Mellon Digital Assets and a decade at Pershing navigating the global securities settlement & capital markets with a combined exposure to $40 Trillion in assets under custody. Experience ranges scaling investment platforms to designing institutional-grade digital asset custody, and trade execution systems for tokenized deposits and securites. (LinkedIn, Twitter)

Mike Fraietta, AKA Multi-Chain Mike

Digital and physical community builder and leader with an absurd amount of experience in startups, co-working spaces, accelerators, and corporations. Previous experience includes working at Filtrbox (part of TechStars' first class, and acquired by Jive Software), News Corporation ( focused on online growth for 20th Century Fox, The Wall Street Journal, and more), and BNY Mellon ( focused on community growth for global "Innovation Centers" and hosted "FinTech Friday"). (LinkedIn, Twitter)

It takes value creation - our combined experience will enable us to outperform our competitors from a relationship and ability perspective to push the CRE industry forward

Infrastructure

Onchain systems and networks will have a role in our technial designs to record our transactions in a secure and transparent way. Interoperability will be a core principal so that we can connect to other businesses and engage meaningfully with our customers as they choose. We will prioritize standards that enable a holistic provenance of ownership, transactions, and utility for our tokens, so that we can create the experiences wand to deliver for our community.

Our team has experience building safe, sound and sustainable systems and we plan to fully embrace the regulatory landscape as its shaped to ensure compliance along with effective anti-money laundering practices that are documented and operationalized to protect our business.

Our content will be supported by enterprise-grade security with 24/7 DDoS mitigation, a sophisticated Web Application Firewall, brute force protection and automatic rate limiting.

And one more thing.... Data

Currently to approximate the value of a building, determine its net operating income and gain insights into its cash flow operations, it takes months to reconcile a complete picture, limiting the ability for investors to make quick investment decisions. With our infrastucure, we can see the real-time value of our building operations, and its related onchain cash flows. We belive commerical mortage back securities markets operators would be very interested in our data to help gain valuable insights into the properties on our network.

Next Stages

Competing in and reimagining the commercial real estate markets will require more investments in later stages. Our purpose in the first year is to demonstrate that we are one of the best teams in the property Tech race, that's able to ship capabilities that attract the largest players. Our experience will allow us to be much more capital efficient in the early stage than companies discovering the field or pivoting to it.

We will work towards convincing both the public and private institutions to trust us for building and implementing the programmable and efficient technology needed to optimize and digitize real-estate, effectively bringing institutions and states to our series A round. To get there, we expect to need to raise in order to scale up and tackle the $34T commercial real estate market and revolutionizing the $146B CRE financial services market.

Lets Show You More.

Grab Time With UsSources:

1| https://twitter.com/FEhrsam/status/1665817199284559873

2| https://mobile-magazine.com/articles/top-10-companies-investing-in-the-metaverse-in-2023

3| https://www.hhs.gov/about/news/2023/05/03/new-surgeon-general-advisory-raises-alarm-about-devastating-impact-epidemic-loneliness-isolation-united-states.html

4| https://hbr.org/2021/02/research-were-losing-touch-with-our-networks

5|https://www.bloomberg.com/news/articles/2023-04-17/brookfield-defaults-on-161-million-debt-for-office-buildings

6| https://www.cbre.com/insights/briefs/us-office-sublease-availability-nearly-doubles-since-pandemic

7| https://cred-iq.com/blog/2023/05/18/office-lease-expirations-commercial-real-estate-looking-ahead-18-months/

8| https://www.cushmanwakefield.com/en/united-states/insights/us-marketbeats/us-office-marketbeat-reports

9| https://www.cushmanwakefield.com/en/united-states/insights/us-marketbeats/us-office-marketbeat-reports

10| https://cred-iq.com/blog/2023/09/08/cred-iq-august-2023-cmbs-delinquency-report/

Member discussion